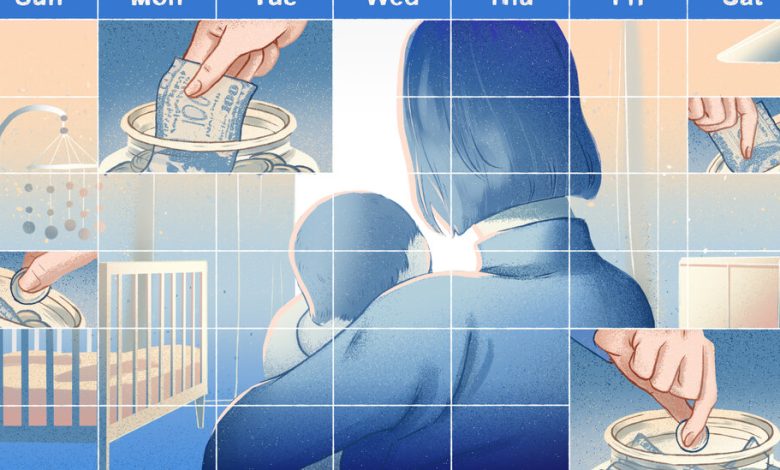

Saving for Retirement on Part-Time Pay: The Challenges for Women

When Robin Giles asks women why they aren’t saving for retirement, they often say the same thing: They don’t make enough money.

“It’s hard to convince people who are just scraping by to feel like they have money to put into retirement savings,” said Ms. Giles, a certified financial planner in Katy, Texas. Socking away money in a retirement account that can’t be touched without penalty until age 59½ is particularly daunting for people living paycheck to paycheck.

Women often find themselves in this position. Some take time out of their careers to have children, and when they return to work, many are self-employed or take lower-wage, part-time jobs — 63 percent of part-time workers in the United States are women, according to the latest data from the Bureau of Labor Statistics. As a result, women frequently make less income than men and have less access to an employer-sponsored retirement plan.

Nearly two-thirds of workers in low-paid jobs are women, with Black, Native American and Latin women particularly overrepresented compared with their shares of the overall work force, according to a study by the National Women’s Law Center. Some women take jobs such as fitness-class instructor, crossing guard or Instacart shopper, or do babysitting and housekeeping work, to get the flexibility they need to take care of their children or aging parents, Ms. Giles said.

“But then they do not make a livable wage, and it’s very difficult to save for retirement when you feel like you’re working for pocket change,” she said.

In light of the benefits of flexibility, the issue of retirement savings has taken an “extremely limited role” in women’s decision-making about staying home with their children, according to a 2022 survey of 1,586 mothers conducted by YouGov that was commissioned by TIAA and designed by the economist Emily Oster. Thirty-three percent of women reported putting “a lot of thought” into the effect that staying at home would have on their retirement savings, while nearly 20 percent said they didn’t think of it, the survey showed.

We are having trouble retrieving the article content.

Please enable JavaScript in your browser settings.

Thank you for your patience while we verify access. If you are in Reader mode please exit and log into your Times account, or subscribe for all of The Times.

Thank you for your patience while we verify access.

Already a subscriber? Log in.

Want all of The Times? Subscribe.